The desire to protect oneself is human nature. Nowhere is that more obvious than when drafting complex commercial real estate deals, where parties often have conflicting goals regarding liability.

The buyer wants to hold the seller accountable for as much as possible for as long as possible. The seller wants to move on as quickly as possible with as little accountability as possible. This clash of "wants" comes to a head in the battle over representations and warranties language. While the buyer typically has a few reps and warranties, the seller may have many, including warranties governing ownership, environmental, leasing, litigation, and condemnation. The seller may also attempt to protect itself by including caps on liability, disclaimers, waivers, and other limits on the reps and warranties.

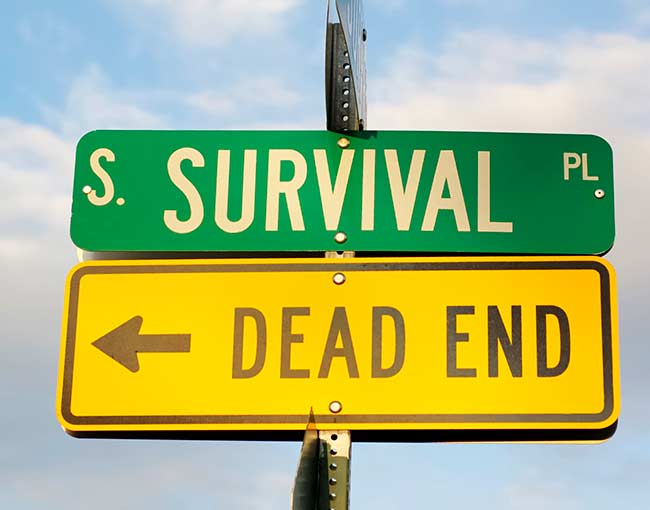

It’s important to note that there are time limits on those reps and warranties. Under common law, all reps and warranties die at closing. Enter: the survival clause: This contractual device bypasses the merger rule by extending the reps and warranties past the closing date. The extension may simply track the statute of limitations for breaches of contract (in California, four years). However, in theory, California courts permit parties to contractually shorten the four-year statute of limitations as well.

But like so many things, reality is a little different than theory. Courts strictly construe survival clauses because they modify the statutory limitation and require language that is "clear and explicit."

Example 1

For example, in one 9th Circuit case, W. Filter Corp. v. Argan, Inc., the court analyzed the following survival clause:

-

“The covenants, agreements, representations and warranties of the parties hereto contained in this Agreement or in any certificate or other writing delivered pursuant hereto or in connection herewith shall survive the Closing until the first anniversary of the closing date.”

The court found fault with the clause’s ambiguous time limit language. It noted that it was difficult to determine what exactly needed to be done within one year: discover a breach or file a lawsuit. It held that, in the absence of clarifying language, courts will construe a time limit as the time within which the breach must occur. Thus, if the defendant in that case had anticipated liability extending for only one year, it was sorely mistaken. As a result of the court’s ruling, the plaintiff needed only to discover the breach within that one-year period. It would then have the default four-year statute of limitations period within which to file a lawsuit.

Example 2

In Amcor Flexibles Inc. v. Fresh Express Inc., another court took to task this clause:

-

“Any action resulting from any breach on the part of [the defendant] as to the goods or services delivered hereunder must be commenced within two years after the cause of action has accrued.”

Here, the issue wasn't whether the lawsuit had to be filed within two years. Instead, the court focused on the basis for the breach. The plaintiff in this case interpreted the clause to cover only breaches related to goods actually purchased or delivered, not breaches related to the defendant’s failure to purchase or deliver. The defendant argued that the clause governed all breaches related to delivery and purchase, including the failure to deliver or purchase. The court found that the contractual language identifying the basis for the breach was unclear. Relying on the appellate mandate to strictly construe survival clauses against the party seeking to enforce it, the court ignored the two-year limitation in the face of the ambiguity. Instead, it found that the default four-year statute of limitations applied.

Example 3

Finally, a Delaware court (looking to California law for guidance) found in GRT, Inc. v. Marathon GTF Tech., Ltd., that the following clause clearly and explicitly explained the statute of limitations applicable to particular reps and warranties:

-

“The representations and warranties of the Parties contained in Sections 3. 1, 3.3, 3.6, 4.1 and 4.2 shall survive the Closing indefinitely, together with any associated right of indemnification pursuant to Section 7.2 or 7.3. The representations and warranties of [plaintiff] contained in Section 3.16 shall survive until the expiration of the applicable statutes of limitations ..., and will thereafter terminate, together with any associated right of indemnification pursuant to Section 7.3. All other representations and warranties in Sections 3 and 4 will survive for twelve (12) months after the Closing Date, and will thereafter terminate, together with any associated right of indemnification pursuant to Section 7.2 or 7.3 or the remedies provided pursuant to Section 7.4.”

Unfortunately, as these cases demonstrate, there is no perfect answer for drafting an impenetrable survival clause. Fortunately, there is some guidance. The default four-year statute of limitations can be reduced if: (1) there is no violation of public policy and (2) the clause does not unduly disadvantage one party (i.e., there is sufficient time in which to effectively pursue litigation, if necessary). One-year time limits for filing a lawsuit have been upheld. More or less time may be reasonable depending on the facts of the case.

So, what are the lessons here? First, be specific, clear, and explicit. Second, be specific, clear, and explicit! Third, be sure to answer these questions in your survival clause: Once you reach the end of the "survival period," must you file a lawsuit, give informal notice, or do you simply have to discover the claim? Then, does the survival clause cover all reps and warranties or only some? Survival clauses are a great tool for both buyers and sellers, as long as they are (once more, with passion) clear, specific and explicit.