Home > Insights > Publications > New SEC pay versus performance rules to increase information reporting regarding executives: What you will need to include in your next proxy statement

The Securities and Exchange Commission (the “SEC”) recently adopted final rules to implement Section 14(i) of the Securities Exchange Act of 1934 (the “Act”), required by Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act. The new rules add Item 402(v) of Regulation S-K (“Item 402(v)”), which requires a public company to disclose the relationship between executive compensation and the company’s financial performance.

Requirements under the Item 402(v)

Item 402(v) applies to all reporting companies except foreign private issuers, registered investment companies and emerging growth companies, and requires disclosure in any proxy or information statement for which disclosure of executive compensation under Item 402 of Regulation S-K is required.

Format of disclosure

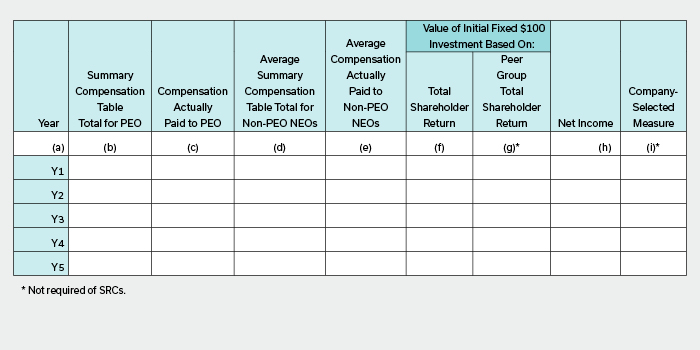

Item 402(v) requires disclosure, in tabular format as shown below, of the following information and metrics for each of the last five fiscal years:[1]

(a) year;

(b) total compensation amount shown in the summary compensation table (“SCT Total”) for the company’s principal executive officer (“PEO”);

(c) compensation actually paid to the PEO;

(d) average SCT Total for the company’s remaining named executive officers (“NEOs”);

(e) average compensation actually paid to the remaining NEOs;

(f) the cumulative total shareholder return (“TSR”) of the company;

(g) the TSR of the company’s peer group;

(h) the company’s net income; and

(i) a measure chosen by the company and specific to the company (“Company-Selected Measure”) as a measure of financial performance.

Companies are required to use the information in the above table to describe, in a narrative or graphic format, or a combination of the two, the following relationships between the values in the above table over the years covered in the table.

- Executive compensation actually paid and the company’s TSR;

- Company TSR and peer group TSR;

- Executive compensation actually paid and net income; and

- Executive compensation actually paid and the Company-Selected Measure.

Companies have discretion to present the descriptions and groupings of these relationships in the form of graphs, narratives, or a combination of the two. However, any combined description of multiple relationships must be clear.

Determining executive compensation actually paid

Item 402(v) sets out requirements for calculating compensation “actually paid” described below.

Pension compensation and deferred compensation

With respect to pension compensation, companies are required to deduct from the SCT Total the aggregate change in the actuarial present value of all defined benefit and actuarial pension plans, and add back the aggregate of the following two components: (1) the actuarially determined service cost for services rendered by the executive during the applicable year (the “service cost”); and (2) the entire cost of benefits granted in a plan amendment (or initiation) during the covered fiscal year that are attributed by the benefit formula to services rendered in periods prior to the plan amendment or initiation (the “prior service cost”), in each case, calculated in accordance with GAAP.

With respect to deferred compensation, the calculation of executive compensation actually paid must include above-market or preferential earnings on deferred compensation that is not tax qualified.

Equity awards

Equity awards are required to be disclosed in the years in which they are granted, and changes in their values must be reported from year to year until the awards have vested or until the company determines that the awards will not vest. “Fair value” must be used to measure of the amount of equity awards.

Equity award amounts reported in the SCT Total in Item 402(v) require the addition (or subtraction, as applicable) of the following:

- the year-end fair value of any equity awards granted in the covered fiscal year that are outstanding and unvested as of the end of the covered fiscal year;

- the amount of change as of the end of the covered fiscal year (from the end of the prior fiscal year) in fair value of any awards granted in prior years that are outstanding and unvested as of the end of the covered fiscal year;

- for awards that are granted and vest in the same covered fiscal year, the fair value as of the vesting date;

- for awards granted in prior years that vest in the covered fiscal year, the amount equal to the change as of the vesting date (from the end of the prior fiscal year) in fair value;

- for awards granted in prior years that are determined to fail to meet the applicable vesting conditions during the covered fiscal year, a deduction for the amount equal to the fair value at the end of the prior fiscal year; and

- the dollar value of any dividends or other earnings paid on stock or option awards in the covered fiscal year prior to the vesting date that are not otherwise reflected in the fair value of such award or included in any other component of total compensation for the covered fiscal year.

Companies must disclose, in a footnote, any valuation assumptions that materially differ from those disclosed at the time of an equity grant. When multiple equity awards are being valued in a given year, a company may disclose a range of the assumptions used or a weighted-average amount for each assumption.

Companies must disclose the dollar value of any dividends or other earnings paid on stock or option awards in the covered fiscal year prior to the vesting date and include that dollar value in the amount of executive compensation actually paid, if such amounts are not reflected in the fair value of such award or included in any other component of total compensation for the covered fiscal year.

Measures of performance

TSR and peer group TSR

Under Item 402(v), TSR is calculated on the same cumulative basis as is used in Item 201(e) of Regulation S-K. Both TSR and peer group TSR should be calculated based on a fixed investment of one hundred dollars at the measurement point.

Companies are required to disclose weighted peer group TSR (weighted according to companies’ stock market capitalization at the beginning of each period for which a return is indicated), using either the same peer group used for purposes of Item 201(e) or a peer group used in the Compensation Discussion and Analysis for purposes of disclosing their compensation benchmarking practices.

Tabular list of the company’s “most important” performance measures

Companies are required to provide a list of three to seven of their “most important” financial performance measures used to link executive compensation actually paid during the fiscal year to company performance (“Tabular List”) and are permitted to include non-financial performance measures in the Tabular List if such measures are among their most important performance measures. The determination of a company’s “most important” financial performance measures is made on the basis of the most recently completed fiscal year.

Companies may disclose the Tabular List in (a) one list including all NEOs; (b) two lists, with one for the PEO and one for all other NEOs; or (c) separate lists for each NEO. SRCs are not required to include a Tabular List.

Company-Selected Measure

The Company-Selected Measure must be a financial performance measure included in the Tabular List, representing the most important performance measure not otherwise disclosed under Item 402(v) by the company. If the company’s “most important” measure is already included in the tabular disclosure, the company should select its next-most important measure as its Company-Selected Measure.

In choosing their Company-Selected Measures, companies must determine which financial performance measure is most important in the same manner in which they determined which most important financial measures to include in their Tabular Lists. Tabular disclosure will include the numerically quantifiable performance of companies under their Company-Selected Measures for each covered fiscal year.

Company-Selected Measures, or additional measures included in the tabular disclosure, may be non-GAAP financial measures.

Permitted additional pay-versus-performance disclosures

Companies are permitted to provide additional pay-versus-performance information beyond what is required by Item 402(v) including additional compensation and performance measures, or additional years of data, so long as doing so would not be misleading and would not obscure the required information. Any supplemental disclosures must be clearly identified as supplemental, not misleading, and not presented with greater prominence than the required disclosure.

Timing of compliance

Companies must begin to comply with the new disclosure requirements in proxy and information statements under Item 402(v) for fiscal years ending on or after December 16, 2022. In light of the new rules and disclosure requirements thereunder, companies should begin compiling the necessary data and financial measures required to be disclosed under Item 402(v) in advance of the 2023 proxy statement.

Allyson Coyne is an associate in Thompson Coburn’s Corporate Finance & Securities practice.

[1] The rules are slightly less onerous for smaller reporting companies (“SRCs”). Specifically, notwithstanding the general five-year disclosure requirement, SRCs must provide the information only for the last two fiscal years in the year in which they first provide the disclosure, and thereafter they must provide the information only for the last three fiscal years. Also, an SRC is not required to disclose the TSR of its peer group ((g) in the table) or a Company-Selected Measure ((i) in the table).